Watch Video

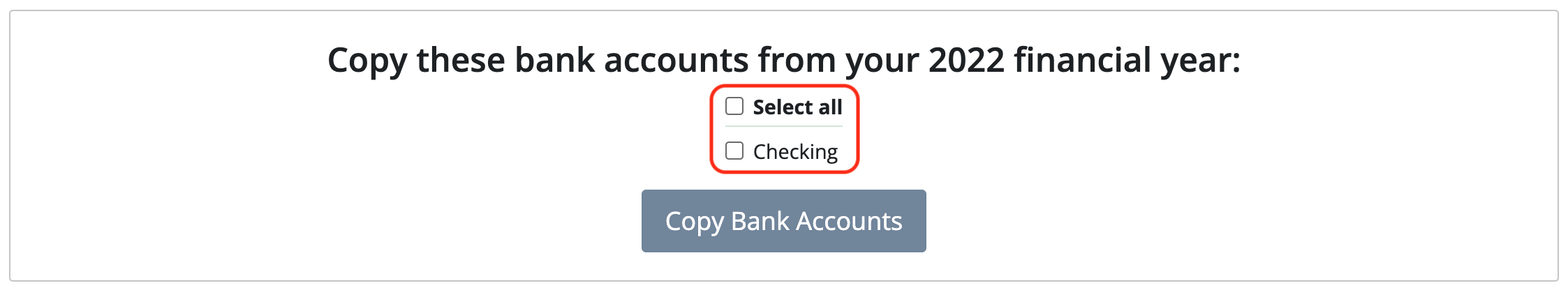

Copying bank accounts from the prior year:

Click the Banking icon in the sidebar.

![]()

MoneyMinder gives the option to select which bank accounts to copy into the new financial year. If the bank accounts are reconciled thru the end of the previous financial year, all uncleared transactions and bank balances can be carried forward into the new financial year.

Select all or select only certain bank accounts to be copied.

Click the Copy Bank Accounts button when selections have been made.

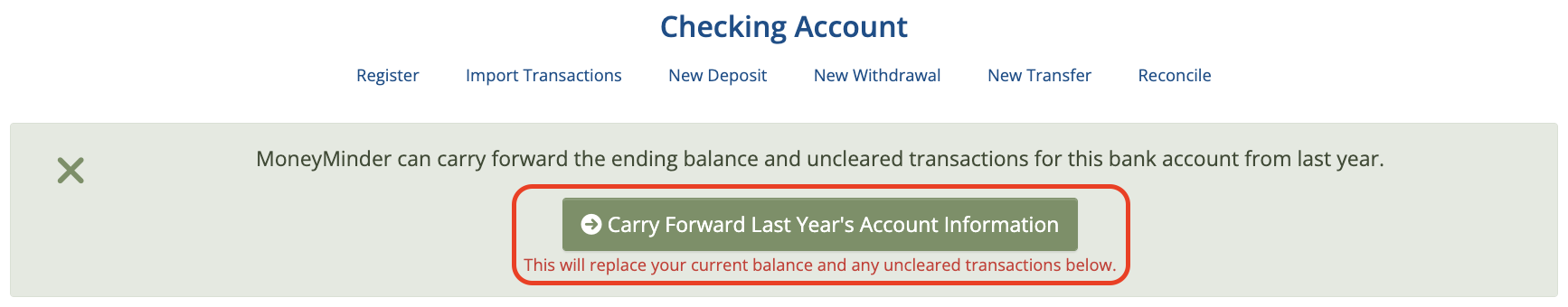

Click the Bank Account Details button to the right of the bank account:

Note: If there is a checkmark next to the Bank Account Details button, that means the account is reconciled through the end of the last financial year and banking can be carried forward into the new financial year.

Click the Carry Forward Last Year’s Account Information button. This will carry forward the bank balance and any uncleared transactions from the prior financial year.

NOTE: This will replace the current balance and uncleared transactions with those copied from the prior year..

Click Save

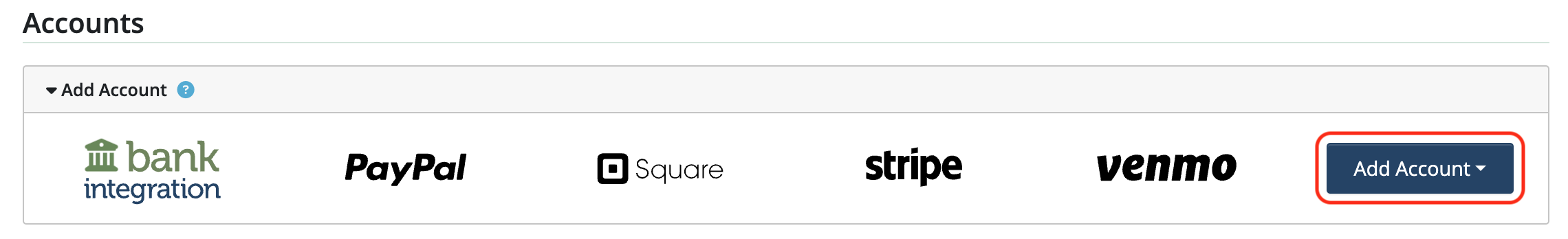

Set up new bank accounts:

Click the Banking icon in the sidebar.

![]()

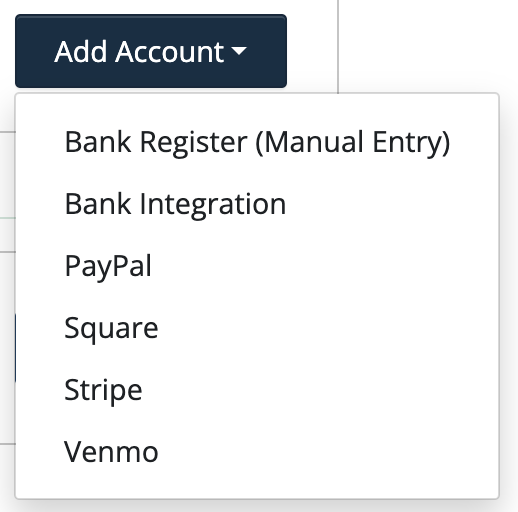

Click the Add Account dropdown.

Choose which type of account to add from the dropdown list.

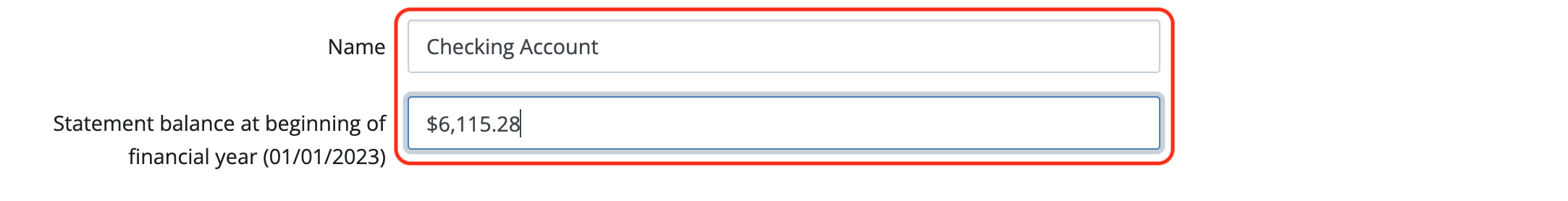

Enter the bank account name and starting balance at the beginning of your financial year. This should be taken directly from the bank statement.

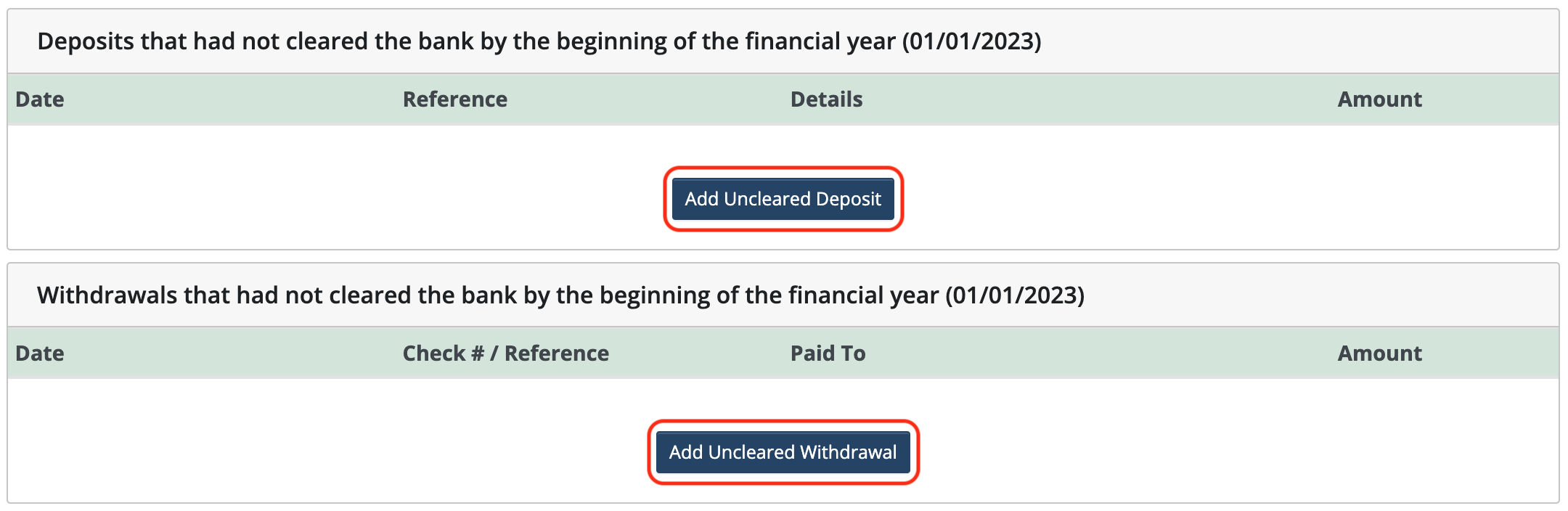

Click Add Uncleared Deposit or Add Uncleared Withdrawal to enter outstanding checks or deposits that were written in the prior financial year but did not clear the bank until after the start of the new financial year.

Note that entries made in this section do not affect current year numbers at all. They are placeholders for bank reconciliations. This is a security measure. It is most transparent to enter the bank statement opening balance, which is easily verifiable, and then enter any known outstanding items to arrive at a true starting balance for the year.

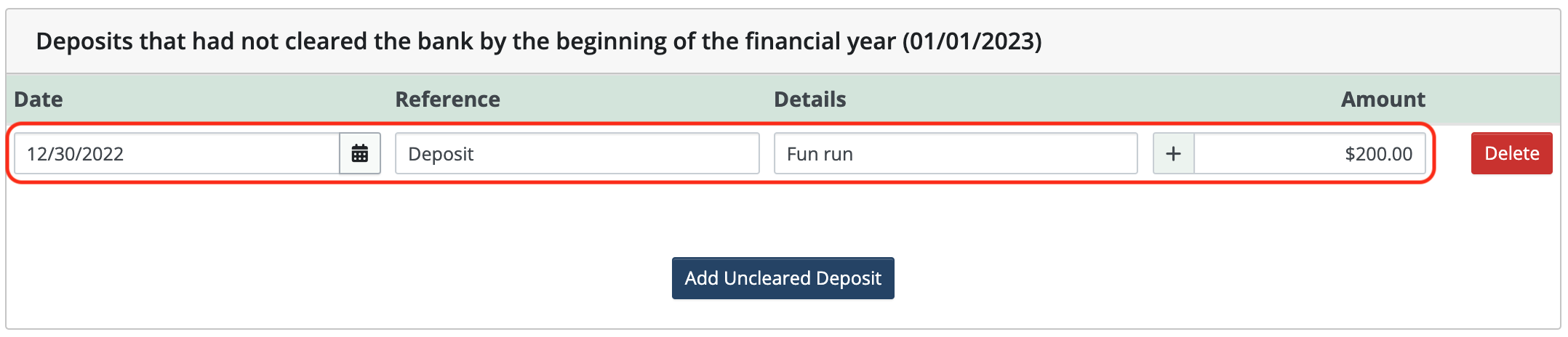

For uncleared deposits: Enter the date, who the money was received from, the amount, and a reference number if any. Continue to do this for every deposit in the previous year that did not show on the bank statement.

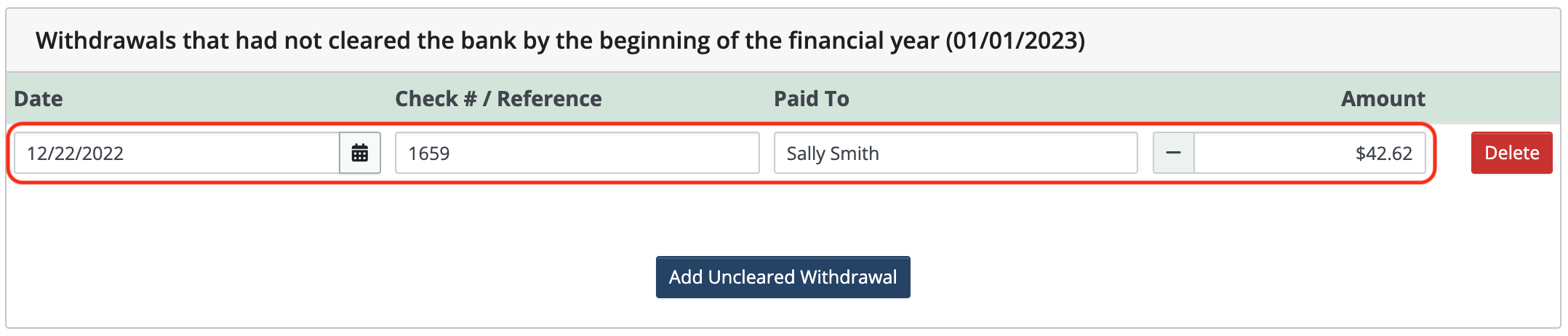

For uncleared withdrawals: Enter the date, who the money was paid to, the amount, and a check or reference number if any.

When finished adding uncleared transactions, click Save.

.

Connect your Venmo account to MoneyMinder PRO to directly download transactions, saving you time and effort. You just review the transactions to ensure they are properly categorized and fill out any required fields.

Connect your Venmo account to MoneyMinder PRO to directly download transactions, saving you time and effort. You just review the transactions to ensure they are properly categorized and fill out any required fields. Connect your Bank, Square and PayPal accounts to MoneyMinder PRO to directly download transactions, saving you time and effort. You just review the transactions to ensure they are properly categorized and fill out any required fields.

Connect your Bank, Square and PayPal accounts to MoneyMinder PRO to directly download transactions, saving you time and effort. You just review the transactions to ensure they are properly categorized and fill out any required fields. Connect your Bank, Paypal and Square accounts to MoneyMinder PRO to directly download transactions, saving you time and effort. You just review the transactions to ensure they are properly categorized and fill out any required fields.

Connect your Bank, Paypal and Square accounts to MoneyMinder PRO to directly download transactions, saving you time and effort. You just review the transactions to ensure they are properly categorized and fill out any required fields. Connect your Bank, Paypal and Square accounts to MoneyMinder PRO to directly download transactions, saving you time and effort. You just review the transactions to ensure they are properly categorized and fill out any required fields.

Connect your Bank, Paypal and Square accounts to MoneyMinder PRO to directly download transactions, saving you time and effort. You just review the transactions to ensure they are properly categorized and fill out any required fields. Join It is a membership management service that helps businesses and nonprofits effectively sell, track, and grow their membership.

Join It is a membership management service that helps businesses and nonprofits effectively sell, track, and grow their membership.

6 Comments

Hi there.

How can I add additional outstanding checks if I accidentally clicked on Save before I was done?

Hi Yessi, you can continue to add those outstanding checks by clicking on Banking > Edit > Add Uncleared Checks. Just be sure to click Save when you want to leave the page.

what does EIN mean exactly?

Your EIN is the Employee Identification Number assigned to you for tax purposes. It’s usually formatted like this: 12-3456789

Is there a way that I can import a membership list from an excel spreadsheet

Hi James,

I’d be happy to help you with that. I just sent you a private email with instructions.

Warm regards,

Cyndi