administration

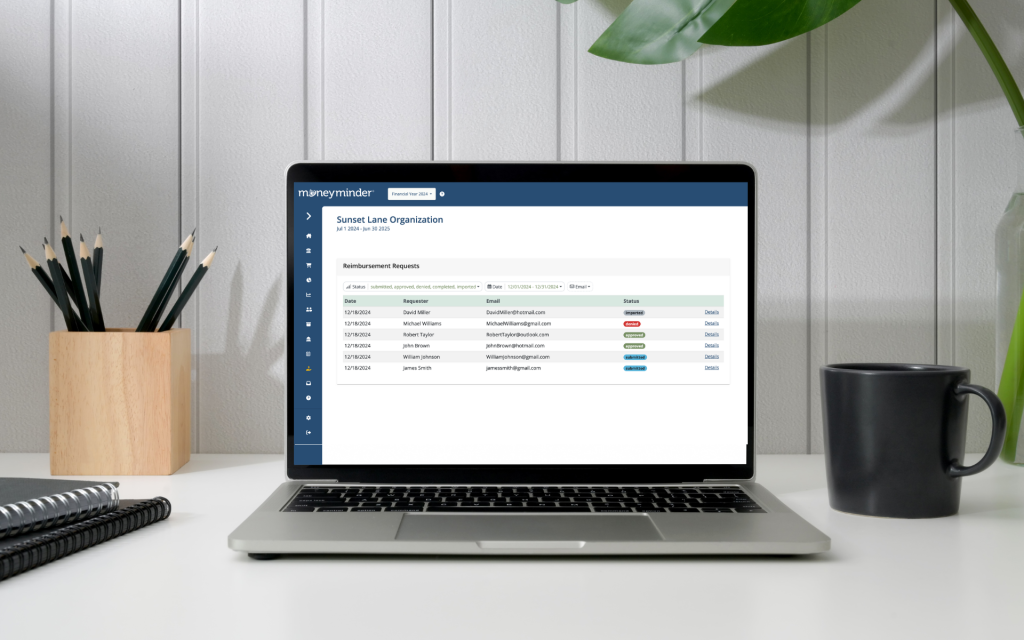

New Features: Compliance, Assets and Reimbursement

Here at MoneyMinder, we’re always working to make nonprofit financial management easier and more efficient. After all, many of you are volunteers with busy schedules. Why juggle multiple tools to ensure financial accuracy for your group? We’re excited to announce some new features launched with MoneyMinder subscriptions in January of 2025. Here’s how these tools…

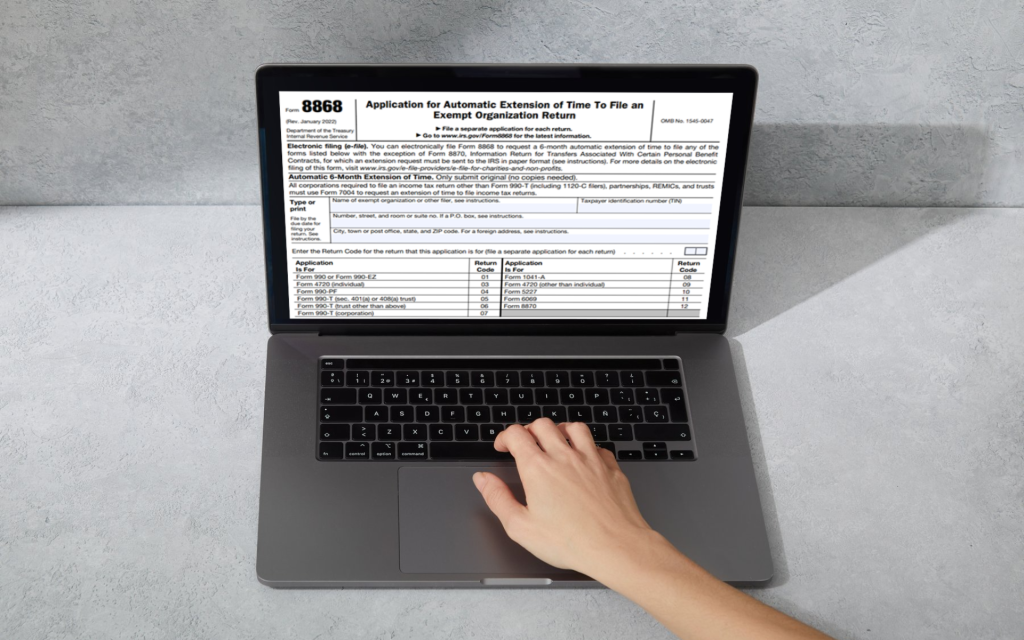

990-EZ Extension: What is IRS Form 8868?

If you’re a small, tax-exempt organization with gross receipts averaging between $50,000 and $200,000, you are likely eligible to file IRS Form 990-EZ. This form is due on the 15th day of the 5th month after your financial year ends. So a group with a January 1 start date needs to file by May 15th.…

8 Strategies for Reducing Conflict in Your Volunteer-Based Nonprofit

Volunteer-based nonprofits are the backbone of many communities. At MoneyMinder, we’ve been working with these groups since 2003 (and volunteering with them for a lifetime). We’ve witnessed how even the most well-intentioned groups can experience conflict. Nonprofit conflict can stem from a variety of sources, such as differing opinions, personality clashes and misunderstandings. Most of…

Nonprofit Best Practices: Fiscal Year Alignment

Many nonprofits find themselves in a situation where their budget period, bylaws and financial software don’t align with their official year as stated with the IRS an their Secretary of State. While it’s possible to manage this with extra effort (and risk), there’s a much simpler solution: fiscal year alignment. Benefits of Fiscal Year Alignment…

What is a Form 990-N?

IRS Form 990-N, often referred to as the “e-Postcard”, is a document that most small, tax-exempt organizations whose annual gross receipts total less than $50,000 must file.

How to Get Volunteers Up to Speed Quickly

As a leader, it can be frustrating when it feels easier to do everything yourself rather than delegate tasks to others. However, building a team or community to help can alleviate stress and further your cause. In this episode of the Two Minute Treasurer’s Tip Podcast, you’ll find tips to make the most out of…

Nonprofit Treasurer Forms & Templates: A Tip From Cyndi

So, you’re the new treasurer? Congratulations! No matter how you got here, you’ve got an important job on your hands. Cyndi is here with some introductory videos to help kickstart you in your new role. The series, called Strong Treasurers, Strong Communities, can be found on YouTube. In this episode, Cyndi has an important suggestion…

How to Get Started as a Group or Club Treasurer

So, you’ve become your group or club’s treasurer! Whether it was a volunteer move or you’ve been lovingly assigned out of necessity, this can be a rewarding responsibility—and a vital one to your club’s success. So, first and foremost, be proud of your newly assigned role. Next, it’s time to make sure you know what…

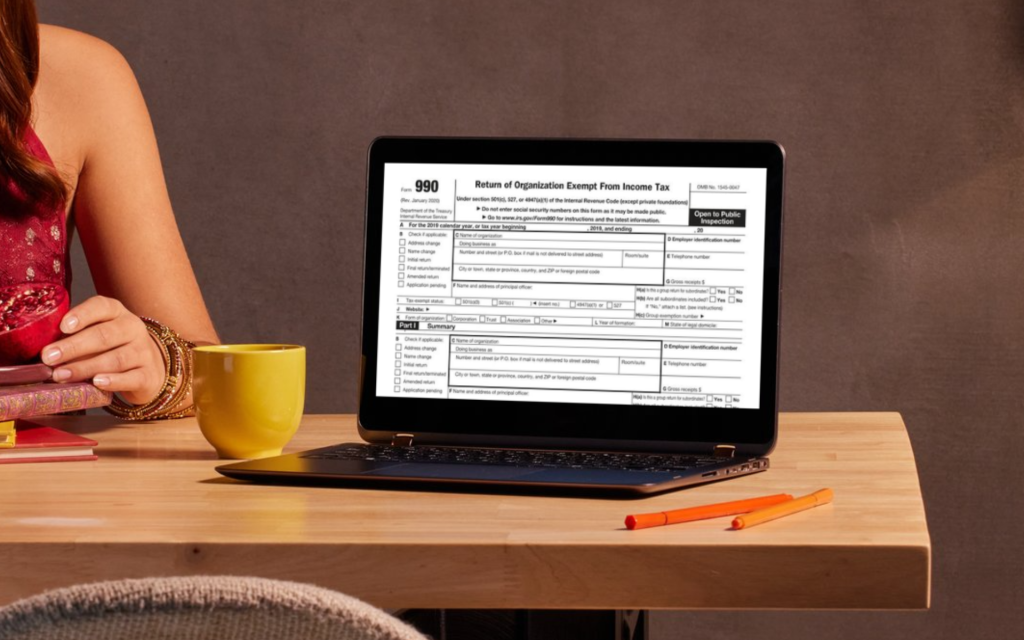

Which Form 990 do PTOs and PTAs Need to File?

The world of tax forms can be confusing for Parent Teacher Organizations (PTOs) and Associations (PTAs). Let’s shed a little light on which form 990 to file. Why File a Form 990? The IRS sets certain rules that tax-exempt organizations, like PTOs and PTAs, must follow to keep their tax-exempt status. One of these requirements…

What to do if Your 501(c)(3) Status Was Revoked

Following is a transcript from this episode of MoneyMinder’s Two Minute Treasurer’s Tip Podcast. Welcome to the Two-Minute Treasurer’s Tip Podcast. I’m Cyndi Meuchel, and today we’re talking about what to do if your group’s tax-exempt status was revoked. According to the IRS, if an organization fails to abide by their rules, they may be…

Connect your Venmo account to MoneyMinder PRO to directly download transactions, saving you time and effort. You just review the transactions to ensure they are properly categorized and fill out any required fields.

Connect your Venmo account to MoneyMinder PRO to directly download transactions, saving you time and effort. You just review the transactions to ensure they are properly categorized and fill out any required fields. Connect your Bank, Square and PayPal accounts to MoneyMinder PRO to directly download transactions, saving you time and effort. You just review the transactions to ensure they are properly categorized and fill out any required fields.

Connect your Bank, Square and PayPal accounts to MoneyMinder PRO to directly download transactions, saving you time and effort. You just review the transactions to ensure they are properly categorized and fill out any required fields. Connect your Bank, Paypal and Square accounts to MoneyMinder PRO to directly download transactions, saving you time and effort. You just review the transactions to ensure they are properly categorized and fill out any required fields.

Connect your Bank, Paypal and Square accounts to MoneyMinder PRO to directly download transactions, saving you time and effort. You just review the transactions to ensure they are properly categorized and fill out any required fields. Connect your Bank, Paypal and Square accounts to MoneyMinder PRO to directly download transactions, saving you time and effort. You just review the transactions to ensure they are properly categorized and fill out any required fields.

Connect your Bank, Paypal and Square accounts to MoneyMinder PRO to directly download transactions, saving you time and effort. You just review the transactions to ensure they are properly categorized and fill out any required fields. Join It is a membership management service that helps businesses and nonprofits effectively sell, track, and grow their membership.

Join It is a membership management service that helps businesses and nonprofits effectively sell, track, and grow their membership.