- Home

- Knowledge Base

- Taxes

- How to e-file the 990-N & 990-EZ

How to e-file the 990-N & 990-EZ

Interested in e-filing your 990-N or 990-EZ through MoneyMinder?

Q: How do I know which 990 form to file?

A: Check this website to get information from the IRS on which form to file:

Q: What do I have to do to prepare for e-filing the 990-N?

A: For the 990-N:

- Have all bank accounts reconciled through the last day of the financial year

- Have your EIN

- Have the name & address of a principal officer

- Gross receipts normally ≤ $50,000

Q: What do I have to do to prepare for e-filing the 990-EZ?

A: For the 990-EZ:

- Have all your bank accounts reconciled through the last day of the financial year

- Have the 990-EZ line codes associated with each budget category

- Gross receipts < $200,000, and Total assets < $500,000

Need help figuring out what line codes to associate with each budget category? Download the “Cheat Sheet”:

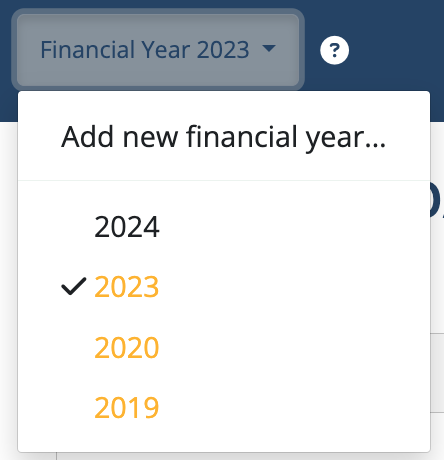

To e-file the 990-N or 990-EZ, choose the Financial Year you want to e-file:

Click the Tax Forms icon in the sidebar.

![]()

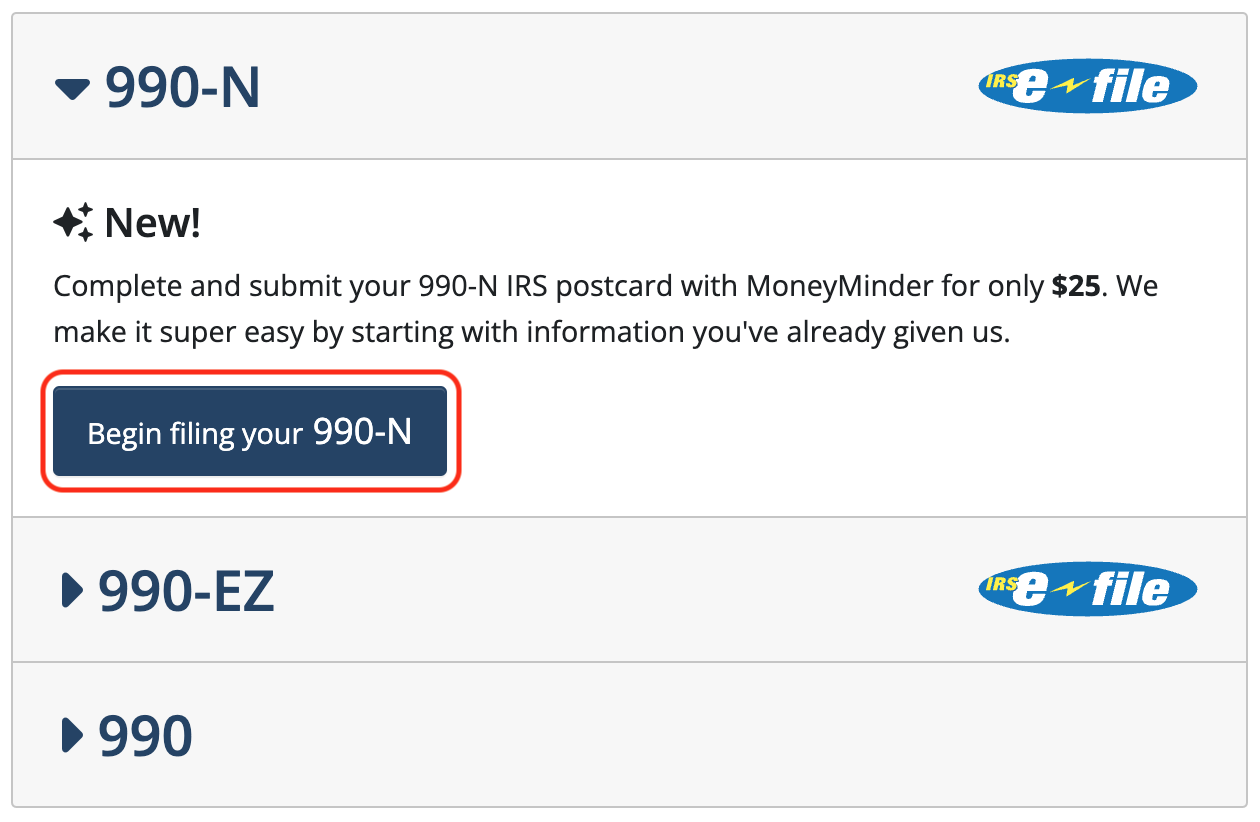

Note: Depending on your gross receipts, MoneyMinder recommends which 990 form to use. This is only a recommendation based on what’s been input into MoneyMinder and may not fully represent the finances of the organization. You will need to check with the IRS to be sure you’re filing the correct 990 form.

To e-file the 990-N:

- Click the Begin filing your 990-N button

2. Follow the steps and enter the necessary information

3. Pay the invoice

4. Submit to the IRS

To e-file the 990-EZ:

- Click the Begin filing your 990-EZ button

2. You will be taken through a series of questions to see if you’re eligible to e-file the 990-EZ through MoneyMinder

3. If you’re eligible, follow the steps and enter the necessary information

4. Pay the invoice

5. Submit to the IRS

Connect your Venmo account to MoneyMinder PRO to directly download transactions, saving you time and effort. You just review the transactions to ensure they are properly categorized and fill out any required fields.

Connect your Venmo account to MoneyMinder PRO to directly download transactions, saving you time and effort. You just review the transactions to ensure they are properly categorized and fill out any required fields. Connect your Bank, Square and PayPal accounts to MoneyMinder PRO to directly download transactions, saving you time and effort. You just review the transactions to ensure they are properly categorized and fill out any required fields.

Connect your Bank, Square and PayPal accounts to MoneyMinder PRO to directly download transactions, saving you time and effort. You just review the transactions to ensure they are properly categorized and fill out any required fields. Connect your Bank, Paypal and Square accounts to MoneyMinder PRO to directly download transactions, saving you time and effort. You just review the transactions to ensure they are properly categorized and fill out any required fields.

Connect your Bank, Paypal and Square accounts to MoneyMinder PRO to directly download transactions, saving you time and effort. You just review the transactions to ensure they are properly categorized and fill out any required fields. Connect your Bank, Paypal and Square accounts to MoneyMinder PRO to directly download transactions, saving you time and effort. You just review the transactions to ensure they are properly categorized and fill out any required fields.

Connect your Bank, Paypal and Square accounts to MoneyMinder PRO to directly download transactions, saving you time and effort. You just review the transactions to ensure they are properly categorized and fill out any required fields. Join It is a membership management service that helps businesses and nonprofits effectively sell, track, and grow their membership.

Join It is a membership management service that helps businesses and nonprofits effectively sell, track, and grow their membership.