Watch Video

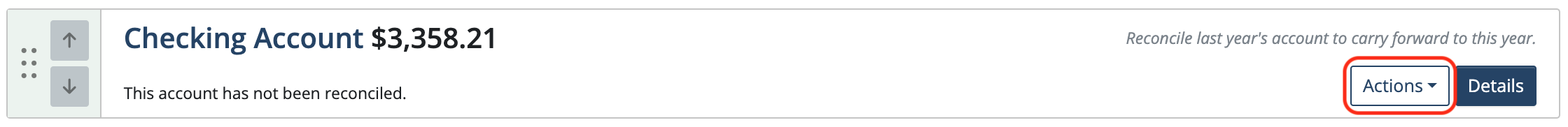

Click the Banking icon in the sidebar.

![]()

Click the Actions dropdown to the right of the bank account.

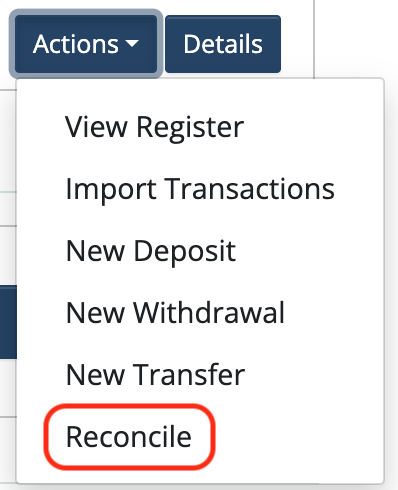

Choose Reconcile from the dropdown.

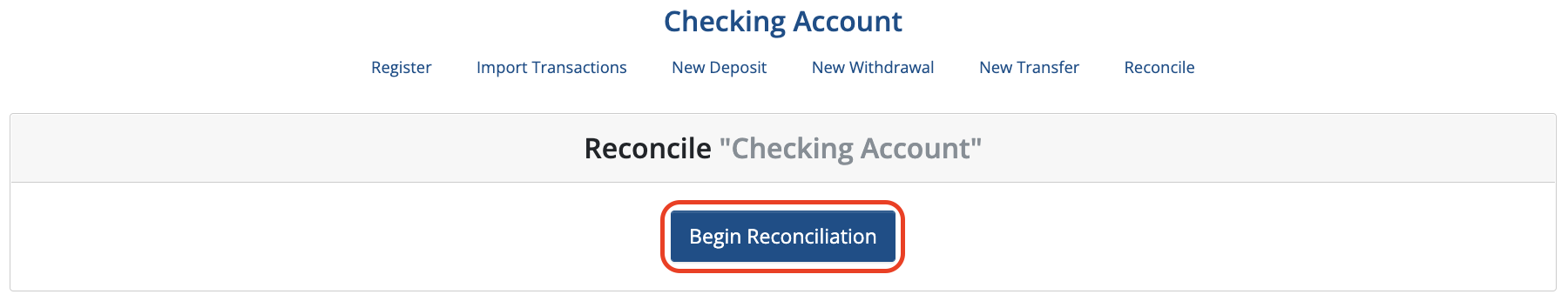

Click Begin Reconciliation.

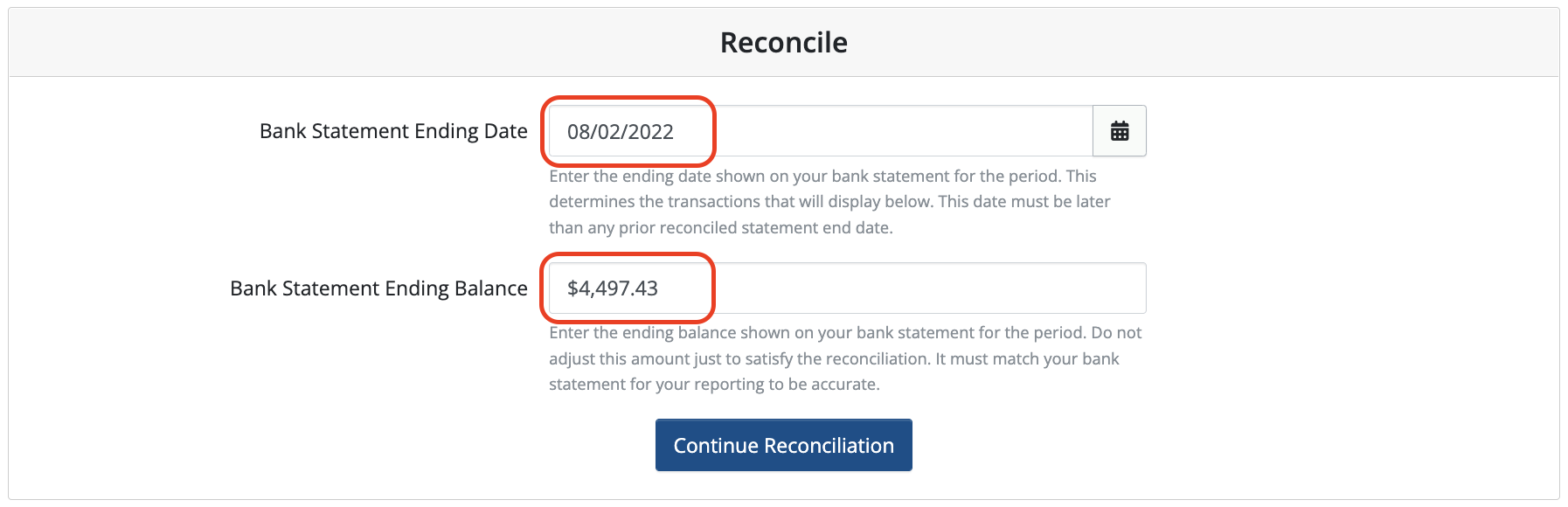

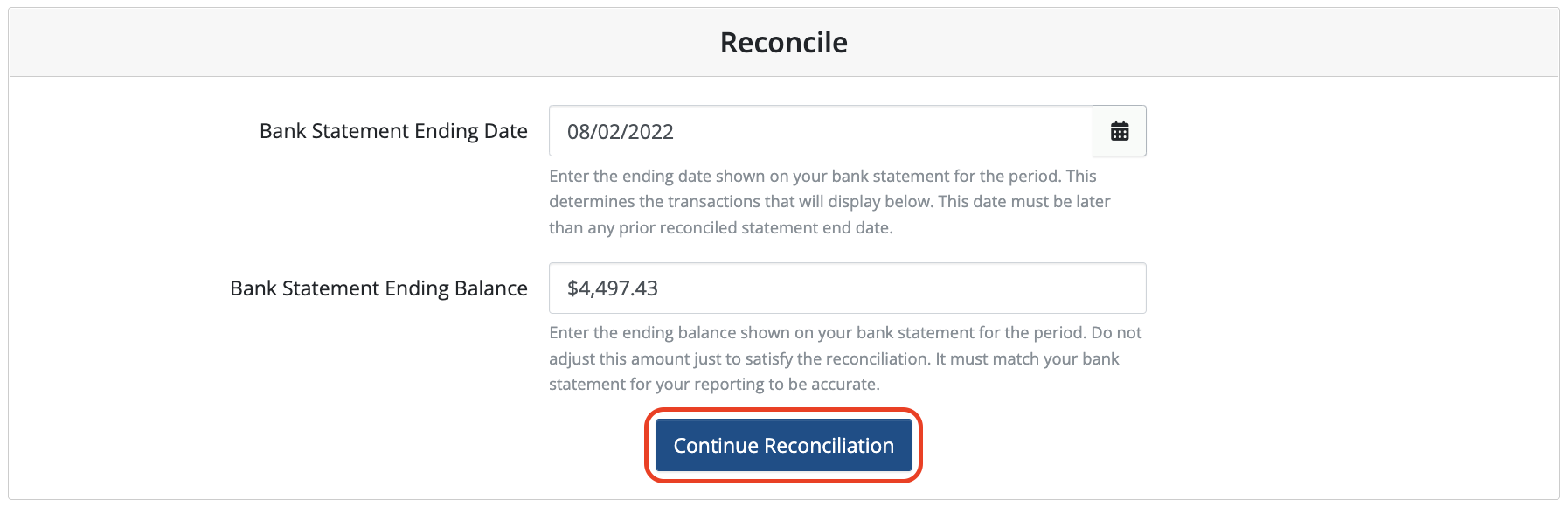

Enter the Bank Statement Ending Date and Ending Balance in the appropriate fields.

Click Continue Reconciliation.

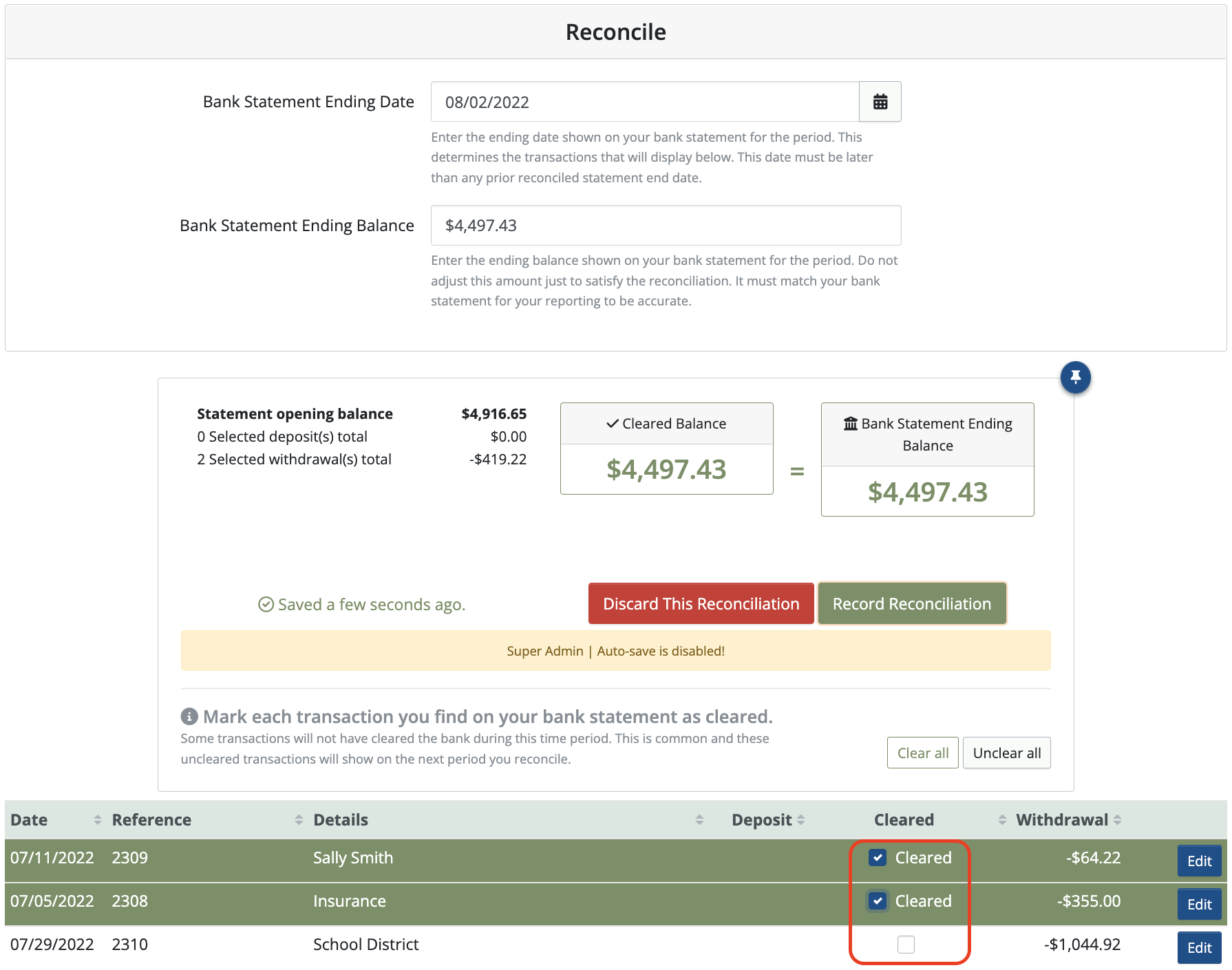

Compare the bank statement to the list of transactions in MoneyMinder’s reconciliation list. For each item that shows on the bank statement that matches MoneyMinder, place a checkmark in the box under the Cleared column.

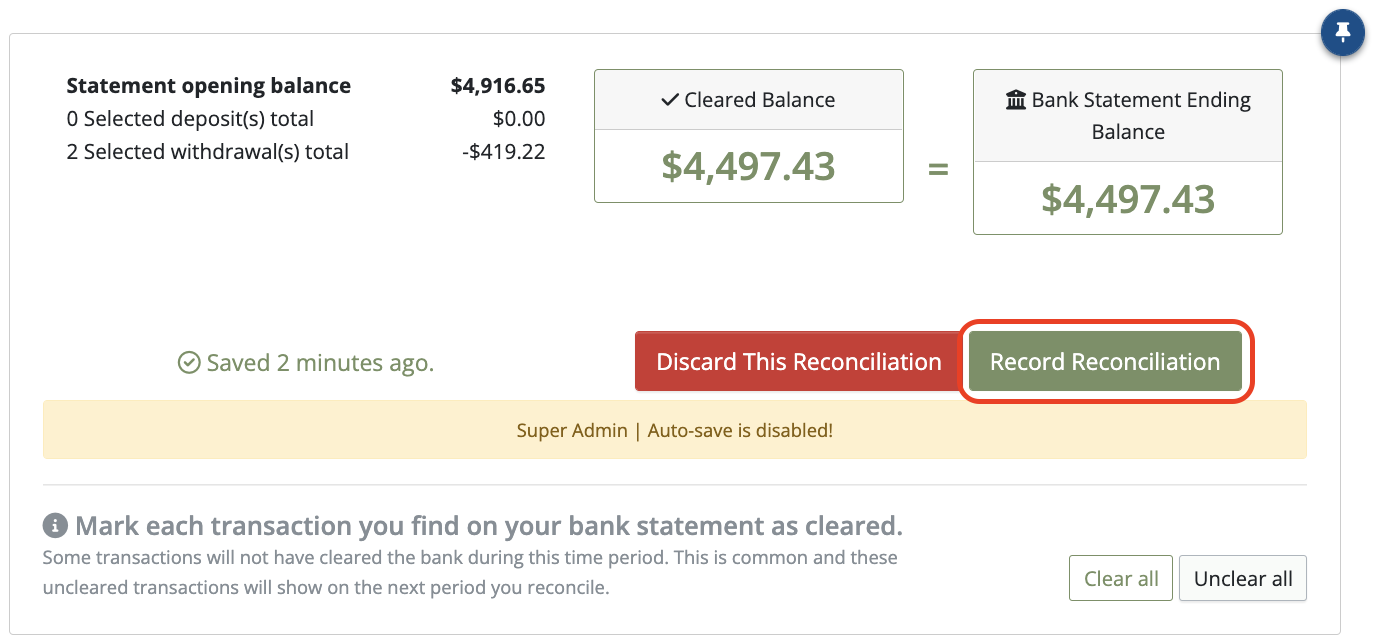

Once all of the transactions that appear on the bank statement have been checked off, look to see if the Record Reconciliation button appears.

If it does, click Record Reconciliation.

If it does not, MoneyMinder and the bank statement do not agree yet. Take a closer look. The most common errors that occur are:

- Transpositions in numbers

- An unrecorded transaction (either a check, deposit, bank fee, or a bank error)

- Entering a transaction into MoneyMinder twice

- Entering an incorrect date on a transaction

MoneyMinder needs to mirror the bank statement and reflect what actually happened at the bank.

Connect your Venmo account to MoneyMinder PRO to directly download transactions, saving you time and effort. You just review the transactions to ensure they are properly categorized and fill out any required fields.

Connect your Venmo account to MoneyMinder PRO to directly download transactions, saving you time and effort. You just review the transactions to ensure they are properly categorized and fill out any required fields. Connect your Bank, Square and PayPal accounts to MoneyMinder PRO to directly download transactions, saving you time and effort. You just review the transactions to ensure they are properly categorized and fill out any required fields.

Connect your Bank, Square and PayPal accounts to MoneyMinder PRO to directly download transactions, saving you time and effort. You just review the transactions to ensure they are properly categorized and fill out any required fields. Connect your Bank, Paypal and Square accounts to MoneyMinder PRO to directly download transactions, saving you time and effort. You just review the transactions to ensure they are properly categorized and fill out any required fields.

Connect your Bank, Paypal and Square accounts to MoneyMinder PRO to directly download transactions, saving you time and effort. You just review the transactions to ensure they are properly categorized and fill out any required fields. Connect your Bank, Paypal and Square accounts to MoneyMinder PRO to directly download transactions, saving you time and effort. You just review the transactions to ensure they are properly categorized and fill out any required fields.

Connect your Bank, Paypal and Square accounts to MoneyMinder PRO to directly download transactions, saving you time and effort. You just review the transactions to ensure they are properly categorized and fill out any required fields. Join It is a membership management service that helps businesses and nonprofits effectively sell, track, and grow their membership.

Join It is a membership management service that helps businesses and nonprofits effectively sell, track, and grow their membership.

17 Comments

I am trying to reconcile our account for our PTA. It’s not being able to work and I’m not sure what is happening.

Hi Tanya,

When you click on the Banking icon in the toolbar, then on Reconcile (under the Checking account), do you get to a window that asks for your bank statement ending date and balance? After you fill out those fields, do you see a list of transactions that you can check off (if they also appear on your bank statement)?

Let me know where you’re having trouble and I’ll walk you thru the steps.

You’re also welcome to email me a copy of your bank statement and I can see if I can identify where the issue might be.

Cyndi

I am reconciling the bank account and I am marking transactions off as cleared during the reconciliation. After completing the reconciliation, an option for a report comes up. When the reconciliation report comes up it tells me several withdrawals or deposits have not cleared the bank which I know they have as I checked the box on the recon that they cleared. I cancelled the reconciliation and re-did it and I got different results on the reconciliation summary report. Something is wrong with the reporting. I noticed this last month and eventually it worked and the reporting was accurate. Can you fix the bug in the report? I always staple the reconciliation summary report to the bank statement and keep for my records. I do not want to do that if the report is inaccurate.

Hi Genia,

Thank you for bringing this issue to our attention! We have turned this over to our IT department. I am sure it is frustrating to have to redo and/or not trust the report. We think it may be related to the auto save feature within the reconciliation. For now, it is suggested that you use the “save in progress” feature when you are reconciling. After checking off the cleared items, save in progress, continue with reconciliation and then print the report. I will reach out to you when I receive more info. Again, thank you!

I’m having this same issue. Please let me know what I can do to get this fixed. I need to print the report to go with the bank statement for our records but the report is not correct. I’ve tried it three times and get different uncleared deposits/withdrawals each time even though I made sure to push ‘Save in progress’ numerous times during the reconciliation.

Hi Christy,

There appears to be a slight delay in saving the reconciliation and the report generating correctly. We are working on resolving that bug. In the meantime, Teri is reaching out to you to give you some tips for resolving this. Please look for an email from her.

I have reconciled every month this fiscal year, but since I uploaded the latest version – my past reconciliations don’t appear to have saved – do I have to go back to my July statements and redo it all.

Note: Since this is our general fund – it is never completely reconciled because there are always outstanding checks from bank statement to bank statement.

Thanks

Hi Carrie,

I’d be happy to help you with those reconciliations. I’ll email you privately so that I can best assist, privately & securely.

Look for an email from me.

Warm regards,

Cyndi

We are reconciling WAY into the next Fiscal Year. When I do the reconciliation for the past year, it records, then says that none of the deposits or withdrawals were cleared before the statement ending date. They all were, and I checked them all. Is there a way to change the ‘not cleared’ to ‘cleared’? It is terrible, and I have tried re-reconciling twice! I really need to close these books!

Hi Chuleana,

Thanks for reaching out. It looks like your reconciliation is indeed recording. I think there may be a slight delay in the process that’s causing it to look like it’s not recorded when it is. I’m having our IT department look into it. I wanted to let you know that it looks like you’re caught up in 2018 though.Let me know if I can help with anything else.

Cyndi

are there plans to add bank recon as a feature to the bank import?

Hi Becky,

Great question! I have included a portion of a Knowledgebase article (https://moneyminder.com/knowledgebase/importing-bank-transactions-from-your-bank/). When you go to reconcile, imported transactions will in fact be pre-checked saving you time 🙂

NOTE: MoneyMinder recognizes duplicate transactions, saving you from accidentally importing duplicate entries. You can also hide your already imported transactions. And best of all, when you go to reconcile, imported transactions are pre-checked, saving you time.

Please let us know whenever we can help!

Warm regards,

Julie

Hi Becky,

If I’m understanding correctly, you’re wondering about auto-checking off of imported entries when you are in the Reconciliation window? If so, yes that does already happen.

Cyndi

I am trying to finish up reconciling our account but the Food/Store Clearing doesn’t seem to be balancing. What might I be doing wrong? Everything else has aligned without an issue

Hi Sara,

I see that a ticket was opened for this and it looks like it was resolved. Please let us know if we can help with anything else!

I am having problems reconciling my account for August 2024. All the numbers on my bank statement and the money minder statement agree. All transactions have cleared. I clicked that for all the Debits and Deposits but it is saying I am not reconciled. I looked at every transaction and they are all correct and line up. It says I am -$3,191.50. When I total all the numbers by hand it balances. I haven’t had this problem before. I am not sure whey the program is telling me it is wrong. Please help.

Hi Sarah,

Feel free to live chat or schedule a call with us so we can help you with your reconciliation. Here is the link to our contact page: moneyminder.com/contact/